Choosing the best cold outreach software in 2026 is no longer a “nice to have”—it’s the backbone of predictable pipeline for Sales, SDR/BDR, and Growth teams across the US, Canada, UK, and Australia 🌍. Done right, cold outreach software stitches together data, deliverability, and personalization so you can reach the right buyers at the right time—without burning domains or budgets 💸. Pairing it with nurture and email automation software best practices sharpens your targeting and accelerates learning cycles. In this definitive guide, you’ll compare tooling, frameworks, laws (CAN-SPAM, CASL, GDPR), and benchmarks to make a confident, revenue-first choice ✅.

Definition for featured snippet: The best cold outreach software centralizes lead targeting, sequencing, personalization, deliverability (warm-up, rotation, verification), and analytics to automate cold outbound at scale 📈. It integrates with CRM, enforces regional compliance, and enables multi-step workflows so teams ship more relevant emails with fewer bounces—consistently.

👉 Start your 14-Day Free Trial ✨

- Understand what great cold outreach software must include (deliverability, data, compliance, AI 🤖)

- See independent rankings and market context with sources 📊

- Follow a step-by-step rollout for US/CA/UK/AU teams 🗂️

- Compare tools and choose confidently for ROI and scale 🚀

- Avoid costly mistakes that crush domain health and reply rates ❌

- What cold outbound tools actually do—and don’t 🧐

- Proof points: ROI, segmentation, automation uplift with citations 📑

- A pragmatic rollout plan for SDR/BDR and Growth ops 🧑💻

- A short list of credible tools to evaluate now 🛠️

- Compliance and deliverability essentials for US/CA/UK/AU 📜

Definition & Context for Best Cold Outreach Software

The best cold outreach software combines list building, inbox infrastructure (warm-up, rotation 🔄), verification ✅, and behavioral sequencing so teams can send high-relevance campaigns at volume. Why does this matter? Email keeps delivering elite ROI: multiple industry reports show email outperforms most channels, with many marketers reporting double-digit to 50x returns depending on maturity and sector (Source: Litmus).

Automation also compounds impact ⚡: long-running benchmarks attribute material revenue lift to triggered and automated flows versus one-off blasts. Campaign Monitor and others report that automated emails can generate several times more revenue than non-automated sends; similarly, segmentation has been associated with outsized revenue effects when relevance and timing improve (Source: Campaign Monitor).

Modern outreach must also respect regional rules 📜. In the US, CAN-SPAM requires including a valid physical address and honoring opt-outs. Canada’s CASL requires consent (express or implied), identification, and a functioning unsubscribe. In the UK/EU, GDPR (with PECR in the UK) governs lawful bases and consent expectations. Great prospecting tools help enforce identity, consent status, and suppression, reducing legal and brand risks across borders (Source: FTC / CRTC / ICO).

- Core stack: inbox warm-up & rotation 🔄, verification ✅, sequencing, CRM sync

- Relevance engine: fields, AI snippets, signals, and conditional logic 🤖

- Compliance guardrails: identity, address, consent and clear opt-out 📜

- Analytics: delivery, opens, clicks, replies, meetings, revenue influence 📊

Benefits of Using the Best Cold Outreach Software

Operationally, the best cold outreach software compounds ROI 💰 by merging deliverability and personalization. Email remains a top-return channel (often quoted around $36 per $1). Automated flows materially outperform manual blasts. When you add segmentation (industry, role, trigger) and device optimization 📱, reply velocity improves and pipeline cycles compress—especially in long B2B sales motions (Source: HubSpot, Campaign Monitor).

- Revenue lift 📈: Automation and segmentation are linked to outsized revenue gains vs. broadcast sending.

- Efficiency ⚡: SDRs/BDRs shift from manual follow-ups to higher-value personalization and discovery.

- Deliverability 📨: Warm-up, rotation, and verification reduce bounces and spam flags at scale.

- Mobile readiness 📱: Half of users may delete non-optimized emails—mobile-first templates protect performance.

- Attribution 🔎: Integrated analytics connect sequences to meetings and revenue, guiding reinvestment.

How to Implement Cold Outreach Software Effectively

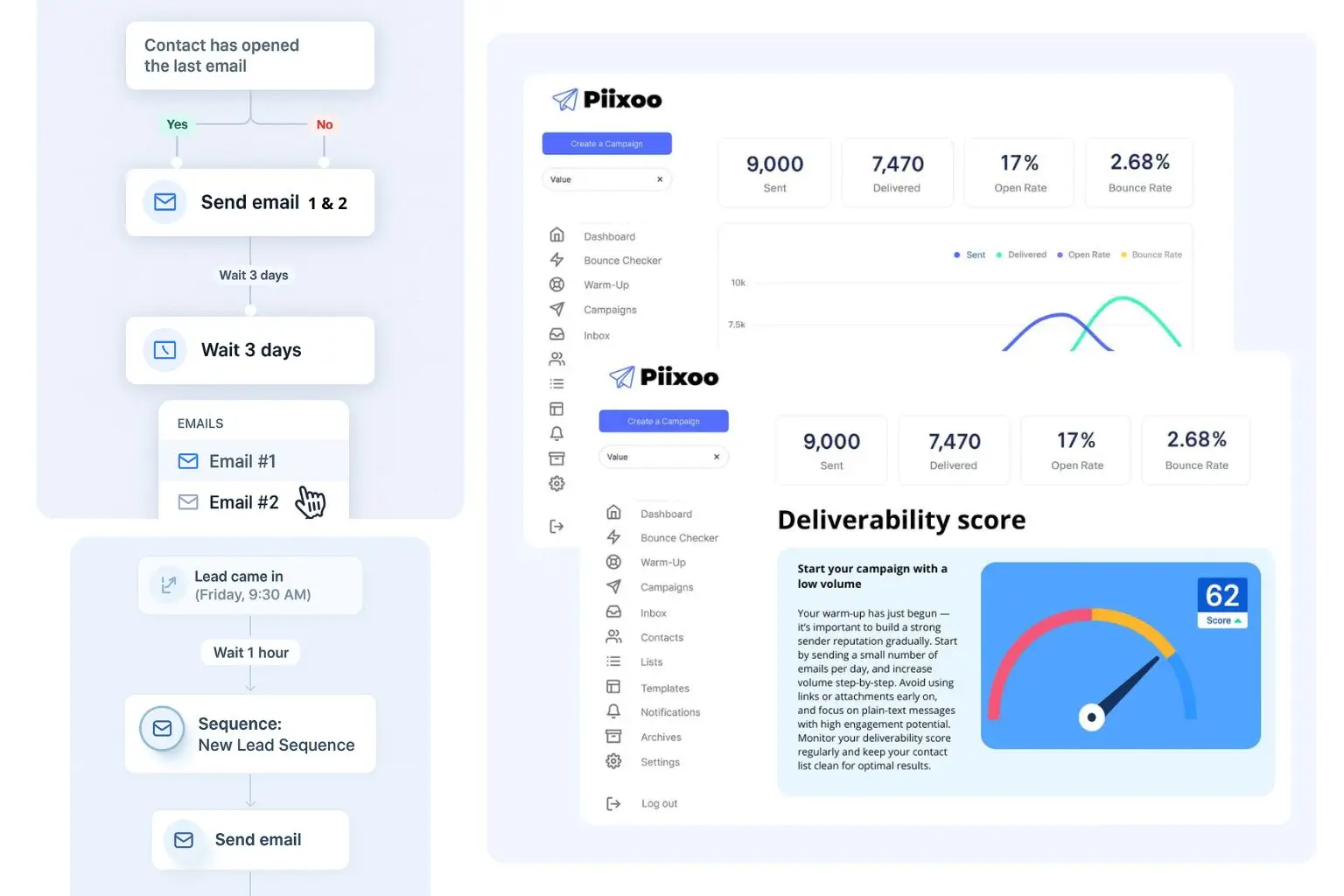

A successful rollout blends strategy, data, and guardrails 🛡️. Start by documenting ICPs and buyer triggers per market (US/CA/UK/AU) and mapping them to outreach moments (first-touch 👋, value nudge 💡, event-based follow-up 📆). Decide where cold outbound tools hand off to nurture, and define success metrics (positive replies, meetings, pipeline). Instrument your stack for deliverability (warm-up, DKIM/SPF/DMARC), verification, and compliance. Select a platform that integrates with your CRM and data sources, supports AI personalization 🤖, and offers granular sequencing logic—the foundation for repeatable experiments and growth 🚀.

Step 1: Goals, Data, and Segmentation

Set explicit targets (e.g., meetings per SDR per week 📅, reply rate %, pipeline $ per month). Build segmented lists (industry, geography, role, tech stack, trigger). Enrich with signals (hiring, funding, tech change) and keep verification in the loop ✅ to minimize bounces. Strong segmentation aligns with evidence that relevance increases opens and revenue 📈, so obsess over message-to-market fit from the first touch.

Step 2: Platform Selection and Compliance

Shortlist tools with deliverability features (warm-up, rotation 🔄), robust sequencing, AI assist 🤖, CRM sync, and permissioning. Confirm compliance helpers: physical address footer (CAN-SPAM), explicit identity and unsubscribe, consent handling for Canada’s CASL, and GDPR/PECR considerations for the UK/EU. Great platforms make these defaults rather than afterthoughts—so your SDRs can focus on conversations 💬, not legal footnotes.

Step 3: Build, Test, and Scale

Begin with a single, well-scoped sequence per ICP 🎯. Test subject lines, angles (problem/impact/proof), send windows ⏰, and CTA micro-conversions. Track delivery, open, click, and—most importantly—positive replies/meetings. Use outcome-based routing (e.g., warm responses → AE handoff; neutral → value follow-up; no-response → different angle). As signals improve, scale volume via warm domains and rotation while watching reputation. Integrate with Piixoo’s cold outreach playbooks to keep testing velocity high while protecting sender health ❤️.

- Do ✅: Warm up domains, authenticate (DKIM/SPF/DMARC), verify contacts, and throttle volume.

- Don’t ❌: Spray-and-pray or ignore unsubscribes—protect reputation and respect laws.

- Do ✅: Localize by market (US/CA/UK/AU) 🌍 and industry cues for relevance.

- Don’t ❌: Over-optimize opens; optimize for conversations and meetings 💬.

- Compliance 📜: Always include identity/address and a one-click unsubscribe.

Top Tools & Resources for Cold Outreach

Independent roundups are useful starting points. Zapier’s 2024/2025 lists highlight Hunter (freelancers), Klenty (AI customization), Instantly (scale), Woodpecker (AI writing), Apollo (engagement), GMass (Gmail-native), and Mailshake (multichannel). Lemlist’s 2025 comparisons emphasize warm-up, inbox rotation, and enrichment. Below are tools worth your shortlist 🛠️:

Tool 1: Piixoo 🚀

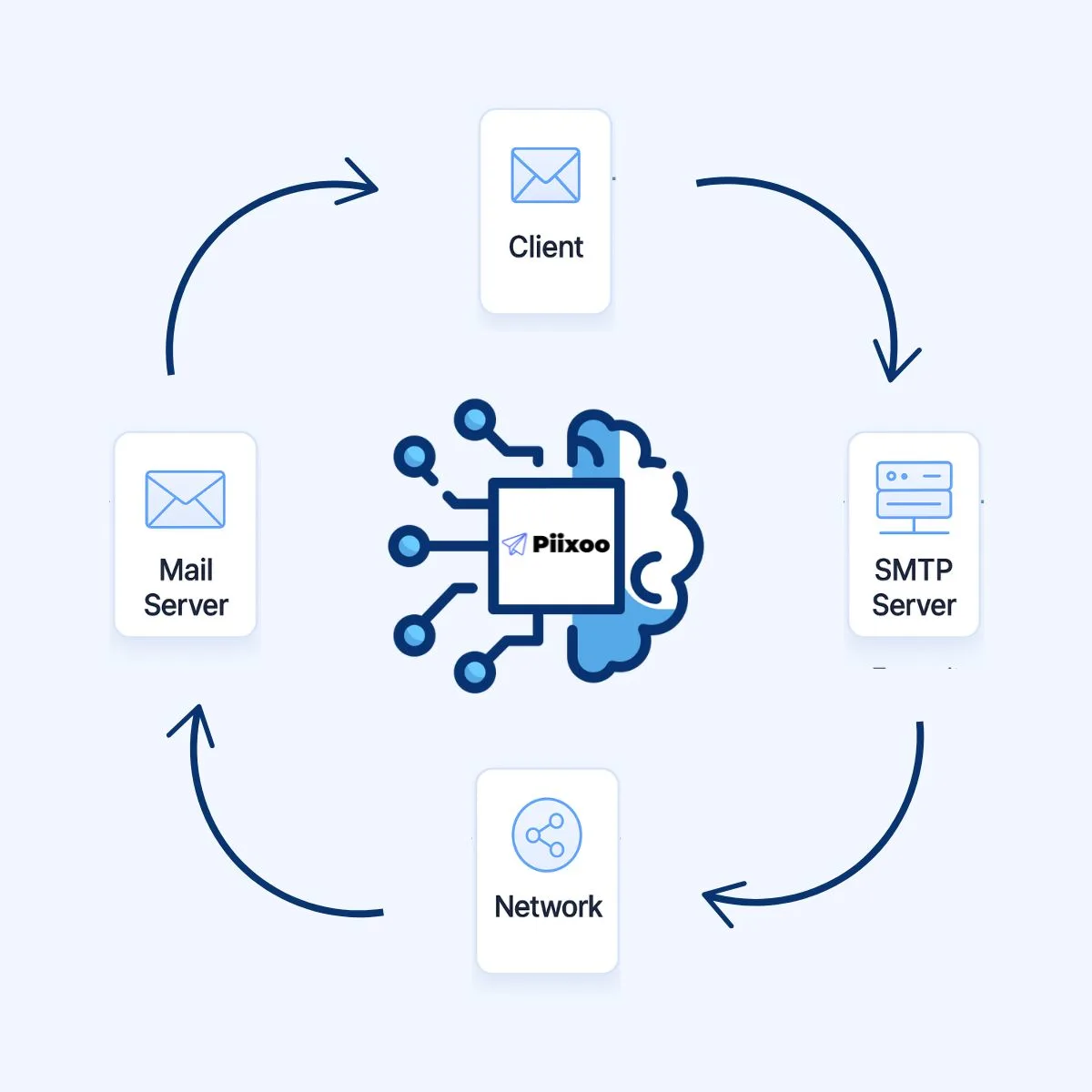

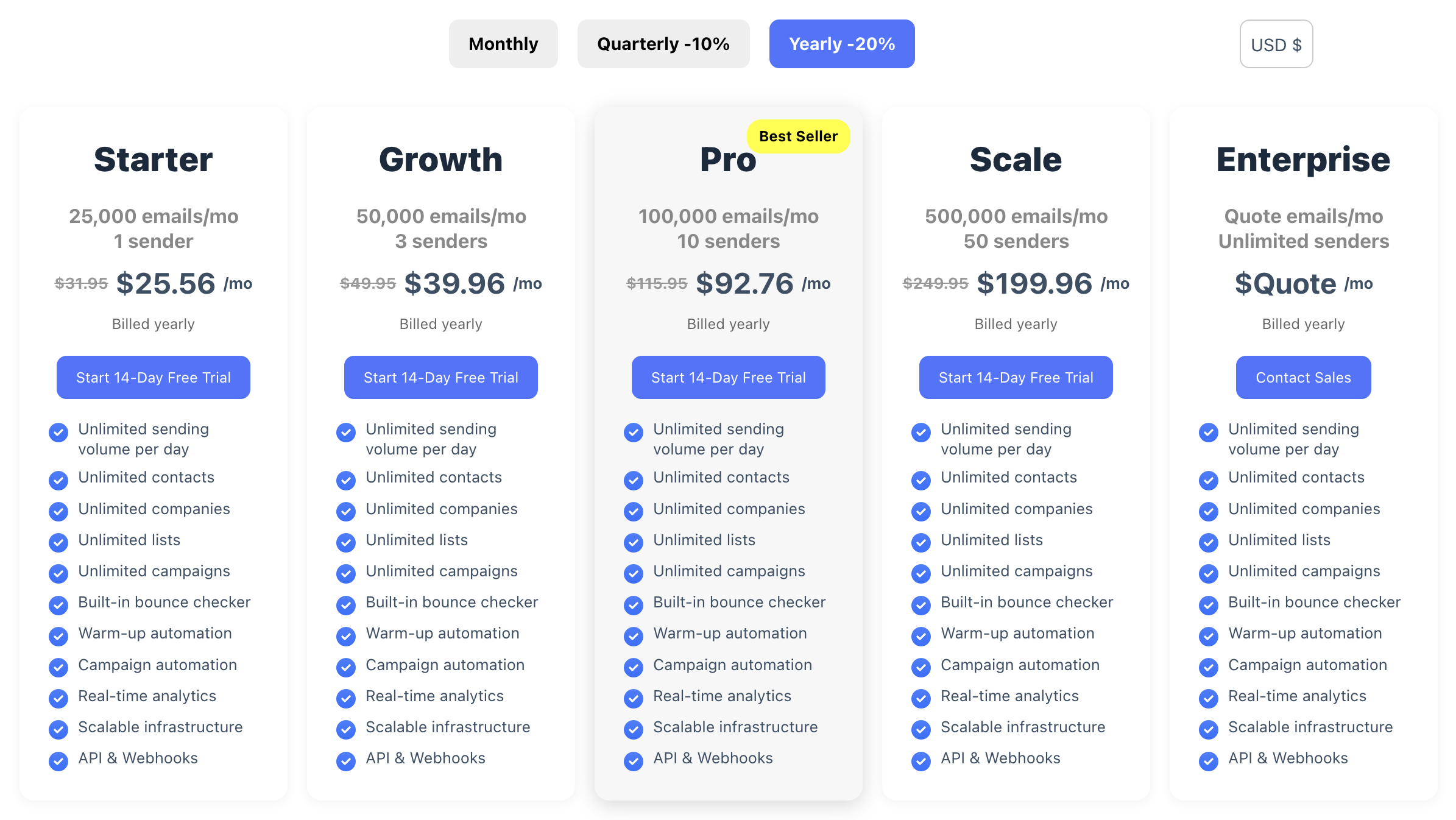

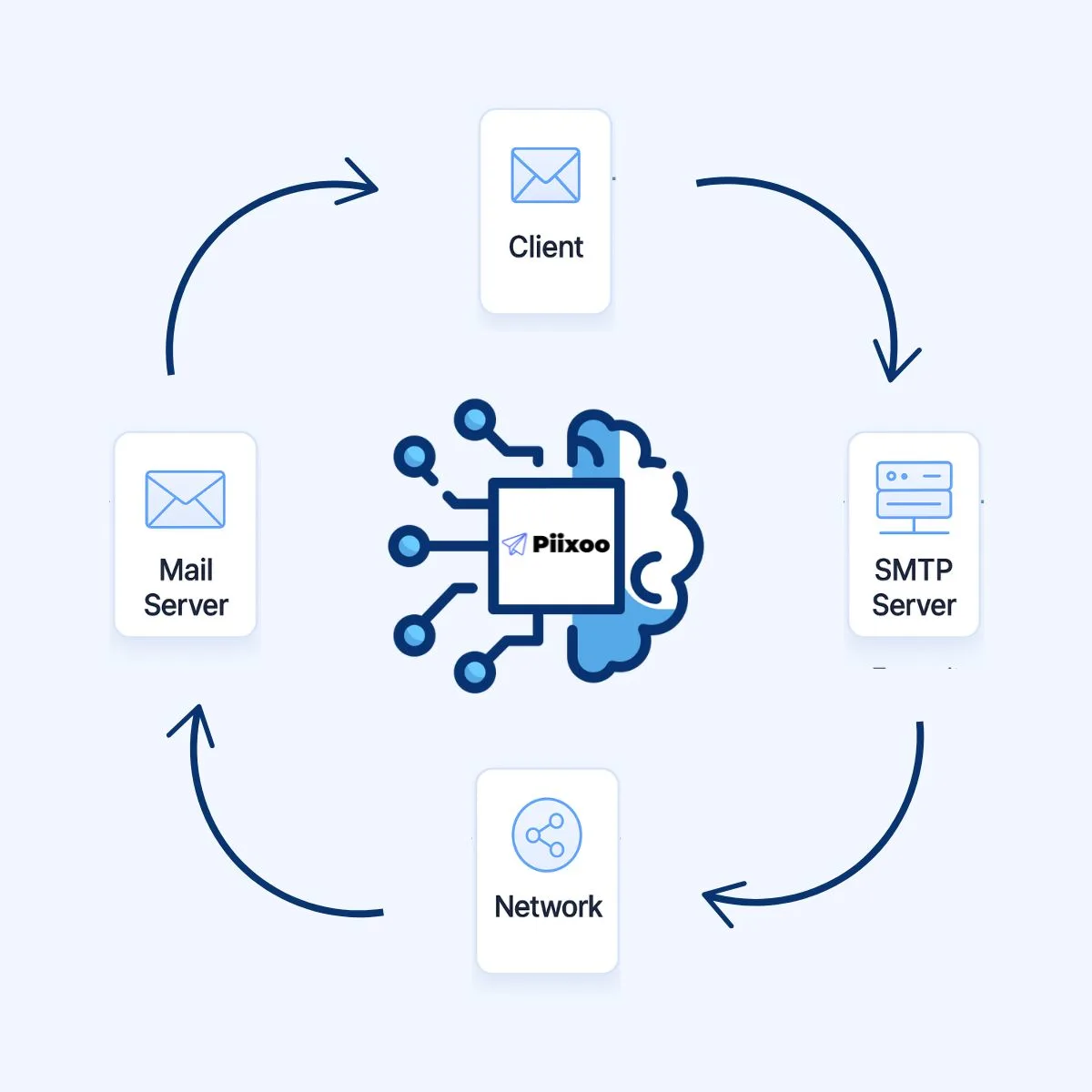

Piixoo is the only cold outreach software designed for unlimited sending 📨, built-in warm-up 🔄, bounce checker ✅, and compliance modules 📜—without add-ons. Perfect for B2B teams, agencies, and startups, Piixoo simplifies complex outreach and scales globally 🌍. If you want an all-in-one prospecting tool that grows with you, Piixoo is the best first choice.

Tool 2: Apollo (Data + Engagement)

Apollo blends prospect data with sequencing and engagement. It’s strong where teams need lead discovery plus outreach in one flow. Consider it if your GTM depends on broad data coverage and you need enrichment at the point of send.

Tool 3: Instantly (Scale & Inbox Infrastructure)

Instantly is often cited for easy scaling via account rotation and warm-up. If your strategy revolves around controlled volume and multi-inbox management, it’s a candidate. Compare against your reputation safeguards and CRM sync needs.

Tool 4: Lemlist (Personalization + Warm-up) ✨

Lemlist is popular for personalized email sequences, visual customization, and strong warm-up features 🔄. It’s often used by Growth teams and agencies for creative campaigns (like video or image personalization). If your strategy values personalization at scale ❤️, Lemlist is a strong addition to your cold outreach stack.

- Compare on: deliverability (warm-up, rotation 🔄), verification ✅, CRM/API coverage

- AI assistance 🤖 (snippets, tone, variable logic) and sequencing depth

- Compliance helpers (identity, address, consent, suppression) 📜

- Analytics tied to meetings and pipeline 📊

- Support and pricing for multi-market scale (US/CA/UK/AU) 🌍

Mistakes to Avoid with Cold Outreach Software

Over-automating Without Relevance ❌

Automating the wrong message to the wrong list faster just damages domains 💥. Resist spray-and-pray. Build ICP-specific angles and proof, and use your prospecting tool to enforce segmentation and throttling.

Ignoring Deliverability and Mobile Experience 📱

Skipping warm-up, authentication, and verification is the fastest way to hit spam folders 🚫. Also, many recipients triage on mobile—non-optimized emails are frequently deleted. Protect domain health first 🛡️; design for small screens; keep CTAs concise and scannable.

Neglecting Compliance in the US/CA/UK/EU 📜

Failing to include identity, a physical address, or one-click unsubscribe violates CAN-SPAM. CASL requires consent and clear identification. UK/EU flows must align to GDPR/PECR. Your cold outreach software should make compliant defaults dead-simple to avoid fines and friction ⚖️.

- Enforce verification and suppression before every send ✅

- Throttle volume; rotate warmed inboxes 🔄; monitor reputation

- Localize messaging for US/CA/UK/AU norms 🌍 and time windows ⏰

- Define success as positive replies/meetings 💬, not opens alone

- Continuously test: subject, angle, proof, CTA, send window 🧪

FAQ

Why use cold outreach instead of only inbound? 🤔

Outbound creates net-new conversations with ICPs you’re not reaching via search or social 🔍. When powered by the best cold outreach software, you orchestrate volume with personalization and compliance, linking sends to meetings and pipeline 📈.

- Fills top-of-funnel with targeted, testable demand 🎯

- Shortens feedback loops on positioning and proof ⚡

- Pairs with nurture to maximize conversion over time 🔄

What features are non-negotiable in cold outreach software? 📋

Deliverability controls (warm-up, rotation), verification ✅, sequencing logic, CRM sync, AI personalization 🤖, analytics tied to meetings/pipeline 📊, and compliance helpers (identity, address, unsubscribe 📜). These guardrails ensure your cold outreach software scales safely across US/CA/UK/AU while keeping replies and reputation healthy.

- Inbox warm-up, DKIM/SPF/DMARC, bounce control 📨

- Segmentation, triggers, conditional branches, throttling 🧩

- One-click unsubscribe, identity/address defaults ✅

How do I compare tools objectively? ⚖️

Start from your GTM reality: data sources, ICPs, geo scope, and team size 👥. Use independent roundups for landscape sanity checks; weigh deliverability, AI, CRM/API depth, and pricing carefully 💰. Where you need data + engagement, evaluate platforms like Apollo; where scale is primary, consider Instantly; where personalization and warm-up matter, evaluate Lemlist. Always run a 2-week pilot against a control sequence before committing.

- Define KPIs (meetings/SDR/week, reply%, pipeline $) 🎯

- Pilot with equal lists; compare outcome metrics 📊

- Stress test support, compliance, and reporting 📜

Conclusion

If you want repeatable pipeline, invest in the best cold outreach software and treat it as an operating system 🖥️: deliverability guardrails, segmented data, compliant defaults, and outcome-based testing. The proof is consistent—email remains a high-return channel 💰, automation and segmentation multiply impact ⚡, and mobile-ready experiences protect engagement 📱. Choose a platform that integrates cleanly with CRM, supports AI-assisted personalization 🤖, and maps sequences to meetings and revenue 📈. Then execute a staged rollout, expanding only as sender reputation and reply quality hold steady. For deeper implementation details and playbooks, see Piixoo’s cold outreach guide and keep iterating until your sequences feel like one-to-one value ❤️, at scale.

👉 One Subscription. All the Tools. Zero Add-Ons. ✨

- Define ICPs and triggers per market (US/CA/UK/AU)

- Warm up inboxes; authenticate; verify every list

- Launch one sequence per ICP; A/B subject/angle/CTA

- Optimize for positive replies and meetings

- Scale domains and rotation only after reputation holds